Volume 7, No. 1, Art. 33 – January 2006

Systemic Risks as Challenge for Policy Making in Risk Governance

Andreas Klinke & Ortwin Renn

Abstract: Systemic risks are a product of profound and rapid technological, economic and social changes that the modern world experiences every day. They are characterised by high complexity, uncertainty, ambiguity, and ripple effects. Due to these characters systemic risks are overextending established risk management and creating new, unsolved challenges for policy making in risk governance. Their negative effects are often pervasive, impacting fields beyond the obvious primary areas of harm. The article relates to an integrative risk concept including evaluation criteria, different risk classes and corresponding management strategies for the handling of systemic risks. We argue that a deliberative approach is needed for risk management and policy making in risk governance to prevent, mitigate or control systemic risks.

Key words: systemic risks, risk management, risk classification, risk management strategies, deliberation, complexity, uncertainty, ambiguity, ripple effects

Table of Contents

1. Introduction

2. Major Characteristics of Systemic Risks

3. Systematic Risk Evaluation

3.1 Inclusion of additional evaluation criteria

3.2 Risk classification: Six different risk classes

4. Risk Management

5. The Need for Deliberation in Risk Management

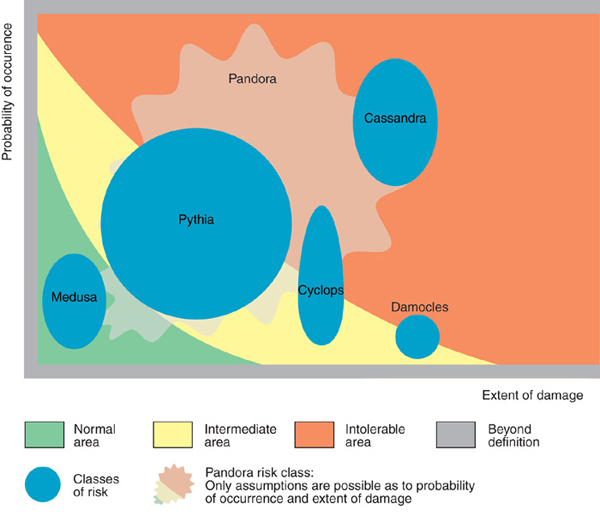

6. Implications for Policy Makers

The recent risk related scandals from BSE to Acrylamide provide ample evidence that there is no simple recipe for evaluating and managing risks. In view of worldwide divergent preferences, variations in interests and values and very few if any universally applicable moral principles, risks must be considered as heterogeneous phenomena that preclude standardised evaluation and handling. At the same time, however, risk management and policy would be overstrained if each risky activity required its own strategy of risk evaluation and management. What risk managers need is a concept for evaluation and management that on the one hand ensures integration of social diversity and multidisciplinary approaches, and on the other hand allows for institutional routines and standardised practices. [1]

This new challenge of risk management is accompanied by the emergence of a new concept of risk, called systemic risks (OECD 2003; RENN et al. 2006). This term denotes the embeddedness of any risk to human health and the environment in a larger context of social, financial and economic risks and opportunities. Systemic risk are at the crossroads between natural events (partially altered and amplified by human action such as the emission of greenhouse gases), economic, social and technological developments and policy driven actions, both at the domestic and the international level. These new interrelated risk fields also require a new from of risk analysis, in which data from different risk sources are either geographically or functionally integrated into one analytical perspective. Systemic risk analysis requires a holistic approach to hazard identification, risk assessment and risk management. Investigating systemic risks goes beyond the usual agent-consequence analysis and focuses on interdependencies and spillovers between risk clusters. [2]

Systemic risk management and evaluation needs to include the following tasks:

Widening the scope of targets for using risk assessment methodologies beyond potential damages to human life and the environment, including chronic diseases; risks to well-being; and interaction with social lifestyle risks (such as smoking, sport activities, drinking and others);

addressing risk at a more aggregate and integrated level, such as studying synergistic effects of several toxins or constructing a risk profile of an individual or collective lifestyle that encompasses several risk causing facilities;

studying the variations among different populations, races, and individuals and getting a more adequate picture of the ranges of sensibilities with respect to operators' performance, lifestyle factors, stress levels, and impacts of external threats;

integrating risk assessments in a comprehensive problem solving exercise encompassing economic, financial and social impacts so that the practical values of its information can be phased into the decision making process at the needed time and that its inherent limitations can be compensated through additional methods of data collection and interpretation;

developing new production technologies that are more forgiving tolerate a large range of human error and provide sufficient time for initiating counteractions. [3]

Modern societies need better concepts for clarifying these new tasks of risk assessment and risk management and developing substantive as well as procedural suggestions for risk management agencies. The basis for such concepts can be taken from a novel approach to risk evaluation, classification and management developed by the German Scientific Advisory Council for Global Environmental Change (WBGU 2000). There are two crucial elements of this approach: first an expansion of factors that should be considered when managing systemic risks; second, the integration of analytic-deliberative processes into the regulatory framework. Both aspects will be discussed in the next sections. [4]

2. Major Characteristics of Systemic Risks

Systemic risks do not only raise primary consequences to human health and the environment, but their hazardousness rather trigger secondary and tertiary impacts, since they are embedded in a larger context of societal, economic and political risks and opportunities. The concept of systemic risks grasps different risk phenomena as well as economic, social and technological developments and policy-driven actions at the national and international level. Systemic risks entail endangering potentials with wide-ranging, transnational impacts where conventional risk management and national risk regulation are insufficient. Four major properties are significant (cf. also KLINKE & RENN 2002):

Complexity refers to the difficulty of identifying and quantifying causal links between a multitude of potential candidates and specific adverse effects. The nature of this difficulty may be traced back to interactive effects among these candidates (synergisms and antagonisms), positive and negative feedback loops, long delay periods between cause and effect, inter-individual variation, intervening variables, and others. It is precisely these complexities that make sophisticated scientific investigations necessary since the dose-effect relationship is neither obvious nor directly observable. Nonlinear response functions may also result from feedback loops that constitute a complex web of intervening variables.

Uncertainty comprises different and distinct components such as statistical variation, measurement errors, ignorance and indeterminacy (cf. VAN ASSELT 2000), which all have one feature in common: uncertainty reduces the strength of confidence in the estimated cause and effect chain. If complexity cannot be resolved by scientific methods, uncertainty increases. But even simple relationships may be associated with high uncertainty if either the knowledge base is missing or the effect is stochastic by its own nature.

Ambiguity denotes the variability of (legitimate) interpretations based on identical observations or data assessments. Most of the scientific disputes in risk analysis do not refer to differences in methodology, measurements or dose-response functions, but to the question of what all this means for human health and environmental protection. Emission data is hardly disputed. Most experts debate, however, whether an emission of x constitutes a serious threat to the environment or to human health. Ambiguity may come from differences in interpreting factual statements about the world or from differences in applying normative rules to evaluate a state of the world. In both cases, ambiguity exists on the ground of differences in criteria or norms to interpret or judge a given situation. An example for such ambiguity is pesticide residues in food where most analysts agree that the risk to human health is extremely low yet many demand strict regulatory actions. High complexity and uncertainty favour the emergence of ambiguity, but there are also quite a few simple and almost certain risks that can cause controversy and thus ambiguity.

Ripple effects indicate the secondary and tertiary consequences regarding time and space, i.e. functional and territorial dimensions of political, social and economic spheres. The cross-border impact of systemic risks exceeds the scope of domestic regulations and state-driven policies. To handle systemic risks interdisciplinary mechanisms in international governance are required. [5]

3.1 Inclusion of additional evaluation criteria

A holistic and systemic concept of risks cannot reduce the scope of risk assessment to the two classic components: extent of damage and probability of occurrence. This raises the question: Which other physical and social impact categories should be included in order to cope with the phenomenological challenges of systemic risks and how can one justify the selection? [6]

The German Advisory Council on Global Change (WBGU 2000) has addressed this problem in its 1998 Annual Report. The Council organised several expert surveys on risk criteria (including experts from the social sciences) and performed a meta-analysis of the major insights from risk assessment and perception studies. The Council also consulted the literature on similar approaches in countries such as United Kingdom, Denmark, Netherlands and Switzerland (WBGU 2000). They asked experts to provide special reports on this issue to the authors. The following criteria were selected as the result of a long exercise of deliberation and investigations:

Extent of damage: adverse effects in natural units such as deaths, injuries, production losses etc.;

probability of occurrence: estimate for the relative frequency of a discrete or continuous loss function;

incertitude: overall indicator for different uncertainty components;

ubiquity defines the geographic dispersion of potential damages (intragenerational justice);

persistency defines the temporal extension of potential damages (intergenerational justice);

reversibility describes the possibility to restore the situation to the state before the damage occurred (possible restoration are e.g. reforestation and cleaning of water);

delay effect characterises a long time of latency between the initial event and the actual impact of damage. The time of latency could be of physical, chemical or biological nature;

violation of equity describes the discrepancy between those who grasp the benefits and those who bear the risks; and

potential of mobilisation is understood as violation of individual, social or cultural interests and values generating social conflicts and psychological reactions by individuals or groups who feel inflicted by the risk consequences. They could also result from perceived inequities in the distribution of risks and benefits. [7]

After the WBGU proposal has been reviewed and discussed by many experts and risk managers, the Center of Technology Assessment in Stuttgart refined the compound criterion "mobilisation" and divided it into four major elements (KLINKE & RENN 2002; RENN & KLINKE 2001):

Inequity and injustice associated with the distribution of risks and benefits over time, space and social status;

psychological stress and discomfort associated with the risk or the risk source (as measured by psychometric scales);

potential for social conflict and mobilisation (degree of political or public pressure on risk regulatory agencies);

spill-over effects that are likely to be expected when highly symbolic losses have repercussions on other fields such as financial markets or loss of credibility in management institutions. [8]

Expanding the scope of criteria for risk evaluation poses a risk in itself. Are risk management institutions able and capable of handling a set of eight criteria (further decomposed in sub-criteria) within the time constraints under which they must operate? Is it realistic to expect risk managers to consider more formal criteria in addition to damage and probability? To be responsive to the new challenges it is necessary to stick with all the criteria, to address the legitimate concerns of risk managers for unambiguous operational rules, it is advisable to introduce the so called "traffic light model", i.e. three categories for handling risks: the normal area, the intermediate area and the intolerable area. [9]

The normal area is characterised by little statistical uncertainty, low catastrophic potential, small numbers when the product of probability and damage is taken, low scores on the criteria: persistency and ubiquity of risk consequences; and reversibility of risk consequences, i.e. normal risks are characterised by low complexity and are well understood by science and regulation. In this case the classic risk formula probability times damage is more or less identical with the "objective" threat. [10]

The intermediate area and the intolerable area cause more problems because the risks touch areas that go beyond ordinary dimensions. Within these areas the reliability of assessment is low, the statistical uncertainty is high, the catastrophic potential can reach alarming dimensions and systematic knowledge about the distribution of consequences is missing. The risks may also generate global, irreversible damages, which may accumulate during a long time or mobilise or frighten the population. An unequivocal conclusion about the degree of validity associated with the scientific risk evaluation is hardly possible. [11]

3.2 Risk classification: Six different risk classes

Given the eight criteria and the numerous sub-criteria, a huge number of risk classes can be deduced theoretically. But a huge number of cases would not be useful for the purpose of placing them in a rather simple traffic light model. Considering the task of generating, legitimising and communicating risk management strategies, risks with one or several extreme qualities need special attention. So such similar risk phenomena are subsumed under one risk class in which they reach or exceed the same extreme qualities. [12]

Events of damages with a probability of almost one were excluded from this classification. High potentials of damages with a probability of nearby one are clearly located in the intolerable area and therefore unacceptable. By the same token, probability heading towards zero is harmless as long as the associated potential of damage is small. Also excluded from the analysis were small-scale accidents (with limited damage potential for each case) that reach large numbers of victims due to their ubiquitous use (such as car accidents). Given these specifications and exceptions, the exercise produced six different risk clusters that the WBGU illustrated with Greek Mythology. The mythological names were not selected for illustrative purposes only (KLINKE & RENN 1999). When studying the Greek mythology of the time between 700 and 500 BC, the Council became aware of the fact that these "stories" reflected the transition from an economy of small subsistence farmers and hunters to an economy of more organised agriculture and animal husbandry. This transition with its dramatic changes implied a new culture of anticipation and foresight. It also marked the transition from a human self-reflection as being an object of nature to becoming a subject to nature. The various mythological figures demonstrate the complex issues associated with the new self-awareness of creating future rather than just being exposed to fate. [13]

Risk class Sword of Damocles

According to the Greek mythology, Damocles was once invited by his king to a banquet. However, at the table he had to eat his meal under a razor-sharp sword hanging on a fine thread. So chance and risk are tightly linked for Damocles and the Sword of Damocles became a symbol for a threatening danger in luck. The myth does not tell about a snapping of the thread with its fatal consequences. The threat rather comes from the possibility that a fatal event could occur for Damocles any time even if the probability is low. This can be transferred to risks with large damage potentials. Many sources of technological risks have a very high disaster potential, although the probability that this potential manifests as a damage is extremely low (cf. Illustration 1). So the prime characteristics of this risk class are its combination of low probability with high extent of damage. Typical examples are technological risks such as nuclear energy, large-scale chemical facilities and dams. [14]

Risk class Cyclops

The Ancient Greeks tell of mighty giants who were punished by only having a single eye, why they were called Cyclops. With only one eye, only one side of reality can be perceived and the dimensional perspective is lost. When viewing risks, only one side can be ascertained while the other remains uncertain. Likewise, for risks belonging to the class of Cyclops the probability of occurrence is largely uncertain, whereas the disaster potential is high and relatively well known (cf. Illustration 1). A number of natural hazards such as earthquakes, volcanic eruptions, floods and El Niño belong to this category. There is often too little knowledge about causal factors. In other cases human behaviour influences the probability of occurrence so that this criterion becomes uncertain. Therefore, the appearance of Aids and other infectious diseases as well as nuclear early warning systems and NBC-weapons also belong to this risk class. [15]

Risk class Pythia

The Ancient Greeks consulted one of their oracles in cases of doubt and uncertainty. The most famous was the Oracle of Delphi with the blind seeress Pythia. Pythia intoxicated herself with gases, in order to make predictions and give advice for the future. However, Pythia's prophecies were always ambiguous. Transferred to risk evaluation that means that both the probability of occurrence and the extent of damage remain uncertain (cf. Illustration 1). So the incertitude is high. This class includes risks associated with the possibility of sudden non-linear climatic changes, such as the risk of self-reinforcing global warming or of the instability of the West Antarctic ice sheet, with far more disastrous consequences than those of gradual climate change. It further includes technological risks as far-reaching innovations in certain applications of genetic engineering in agriculture and food production, for which neither the maximum amount of damage nor the probability of certain damaging events can be estimated at the present point in time. [16]

Risk class Pandora's box

The old Greeks explained many hazards with the myth of Pandora's box. This box was brought down to earth by the beautiful Pandora, who was created by the god Zeus. Unfortunately, the box contained many evils and scourges in addition to hope. As long as the evils and scourges stayed in the box, no damage at all had to be feared. However, when the box was open, all evils and complaints were released and caused irreversible, persistent and wide-ranging damages. A number of human interventions in the environment also cause wide-ranging, persistent and irreversible changes without a clear attribution to specific damages—al least during the time of diffusion. Often these damages are discovered only after the ubiquitous diffusion has occurred.

Illustration 1: Risk classes (Source: WBGU 2000) [17]

Risk class Cassandra

Cassandra, a seeress of the Trojans, predicted correctly the perils of a Greek victory, but her compatriots did not take her seriously. The risk class Cassandra dwells on this paradox: The probability of occurrence as well as the extent of damage are high and relatively well known, but there is a considerable delay between the triggering event and the occurrence of damage. That leads to the situation that such risks are ignored or downplayed. The anthropogenic climate change and the loss of biological diversity are such risk phenomena. Many types of damage occur with high probability, but the delay effect leads to the situation that no one is willing to acknowledge the threat. Of course, risks of the type Cassandra are only interesting if the potential of damage and the probability of occurrence are relatively high. That is why this class is located in the "intolerable" red area (cf. Illustration 1). [18]

Risk class Medusa

The mythological world of the ancient Greek was full of dangers that threaten people, heroes and even Olympic gods. The imaginary Gorgons were particularly terrible. Medusa was one of the three imaginary Gorgon sisters, who the ancient Greek feared, because her appearance turns the beholder to stone (cf. Illustration 1). Similar to the Gorgons, who spread fear and horror, some new phenomena have a similar effect on modern people. Some innovations are rejected although they are hardly assessed scientifically as threat, but they have special characteristics that make them individually or socially frightening or unwelcome. Such phenomena have a high potential of psychological distress and social mobilisation in public. This risk class is only of interest if there is a particularly large gap between lay risk perceptions and expert risk analysis. A typical example is electromagnetic fields, whose extent of damage was assessed as low by most experts because neither epidemiologically nor toxicologically significant adverse effects could be proven (WIEDEMANN, MERTENS & SCHÜTZ 2000). Exposure, however, is wide-ranging and many people feel involuntarily affected by this risk. [19]

The essential aim of the risk classification is to locate risks in one of the three risk areas in order to be able to derive effective and feasible strategies for risk management as well regulations and measures for the risk policy on the different political levels. The characterisation provides a knowledge base so that political decision makers have better guidance on how to select measures for each risk class. The strategies pursue the goal of transforming unacceptable into acceptable risks, i.e. the risks should not be reduced to zero but moved into the normal area, in which routine risk management becomes sufficient to ensure safety and integrity.

|

Management |

Risk class |

Extent of damage |

Probability of occurrence |

Strategies for action |

|

Science-based |

Damocles |

|

|

|

|

Cyclops |

|

|

||

|

Precautionary |

Pythia |

|

|

|

|

Pandora |

|

|

||

|

Discursive |

Cassandra |

|

|

|

|

Medusa |

|

|

Illustration 2: Overview of the management strategies [20]

A comparative view on the risk classification scheme (Illustration 2) indicates that one can distinguish three central categories of risk management, namely science-based, precautionary and discursive strategies. The two risk classes Damocles and Cyclops require mainly science-based management strategies—more precise the Cyclops-risk class need a combination of risk-based and precautionary strategies—, the risk classes Pythia and Pandora demand the application of the precautionary principle, and the risk classes Cassandra and Medusa require discursive strategies for building consciousness, trust and credibility. These three management strategies relate to the main challenges of risk management: complexity, uncertainty and ambiguity. [21]

5. The Need for Deliberation in Risk Management

How can one deal with complexity, uncertainty and ambiguity in risk management? Deliberative methods should play a major role to cope with all three challenges (KLINKE & RENN 2002). First, resolving complexity requires deliberation among experts. This type of deliberation can be framed as "epistemological discourse" (RENN 2003). Within an epistemological discourse experts (not necessarily scientists) argue over the factual assessment with respect to the criteria that the WBGU proposed. The objective of such a discourse is the most adequate description or explanation of a phenomenon (for example the question, which physical impacts are to be expected by the emission of specific substances). The more complex, the more multi-disciplinary and the more uncertain a phenomenon appears to be, the more necessary is a communicative exchange of arguments among experts. The goal is to achieve a homogeneous and consistent definition and explanation of the phenomenon in question as well as a clarification of dissenting views. The discourse produces a profile of the risk in question on the selected criteria. Epistemological discourses are well suited for risks that fall in the category of Damocles and Cyclops. [22]

If risks are associated with high uncertainty, scientific input is only the first step of a more complex evaluation procedure. It is still essential to compile the relevant data and the various arguments for the positions of the different science camps. Information about the different types of uncertainties has to be collected and brought into a deliberative arena. This type of discourse requires the inclusion of stakeholders and public interest groups. The objective here is to find the right balance between too little and too much precaution. There is no scientific answer to this question and even economic balancing procedures are of limited value, since they stakes are uncertain. This type of deliberation could be framed as "reflective discourse". Reflective discourse deals with the clarification of knowledge (similar to the cognitive) and the assessment of trade-offs between the competing extremes of over- and underprotection. Reflective discourses are mainly appropriate as means to decide on risk-averse or risk-prone approaches to innovations. This discourse provides answers to the question of how much uncertainty one is willing to accept for some future opportunity. Is taken the risk worth while the potential benefit? Reflective discourses are best suited to deal with risks that fall in the category of Pythia and Pandora. [23]

The last type of deliberation, which can be framed as participatory discourse, is focused on resolving ambiguities and differences about values. Established procedures of legal decision making, but also novel procedures, such as mediation and direct citizen participation belong to this category. Participatory discourses are mainly appropriate as means to search for solutions that are compatible with the interests and values of the people affected and to resolve conflicts among them. This discourse involves weighting of the criteria and an interpretation of the results. Issues of fairness and environmental justice, visions on future technological developments and societal change and preferences about desirable lifestyles and community life play a major role in these debates. Participatory discourses are best suited for dealing with risks falling into the category of Medusa and Cassandra. [24]

6. Implications for Policy Makers

The central question for policy makers are about the suitable approaches and instruments as well as the adequate risk assessment practices to understand the impacts of risks and to assess and evaluate their contribution to health-related, environmental, financial and political risks (and, of course, opportunities). In addition, the link to strategic policy concerns as they relate to economic development and governance needs to be clarified. One of the most challenging topics here is the interpenetration of physical, environmental, economic and social manifestations of risks. Risk management is not only a task for risk management agencies, but also an imperative mandate for organisations dealing with the economic, financial, social and political ramifications. [25]

It is not sufficient any more to look into the probability distribution of potential losses associated with a risk source. To establish a framework for good governance, a more stringent, logically well-structured and promising decision-making process is required. Risk managers need new principles and strategies, which are globally applicable to manage systemic risks. Good governance seems to rest on the three components: knowledge, legally prescribed procedures and social values. It has to reflect specific functions, from early warning (radar function), over new assessment and management tools leading to improved methods of effective risk communication and participation. [26]

The promises of new developments and technological breakthroughs need to be balanced against the potential evils that the opening of Pandora's box may entail. This balance is not easy to find as opportunities and risks are emerged in a cloud of uncertainty and ambiguity. The dual nature of risk as a potential for technological progress and as a social threat demands a dual strategy for risk management. It will be one of the most challenging tasks of the risk community to investigate and propose more effective, efficient and reliable methods of risk assessment and risk management while, at the same time, ensure the path towards new innovations and technical breakthroughs. [27]

Klinke, Andreas & Renn, Ortwin (1999). Prometheus unbound. Challenges of risk evaluation, risk classification, and risk management. Working Paper No. 153 of the Center of Technology Assessment. Stuttgart: Center of Technology Assessment.

Klinke, Andreas & Renn, Ortwin (2002). A new approach to risk evaluation and management: Risk-based, precaution-based and discourse-based strategies. Risk Analysis, 22(6), 1071-1094

OECD (2003). Emerging systemic risks. Final report to the OECD futures project. Paris: OECD.

Renn, Ortwin (2003). The challenge of integrating deliberation and expertise: Participation and discourse in risk management. In Timothy MacDaniels & Mitchell Small (Eds.), Risk analysis and society: An interdisciplinary characterisation of the field (pp.289-366), Cambridge: Cambridge University Press.

Renn, Ortwin & Klinke, Andreas (2001). Environmental risk—perception, evaluation and management: Epilogue. In Gisela Böhm, Josef Nerb, Timothy McDaniels & Hans Spada (Eds.), Environmental risks: Perception, evaluation and management (pp.275-299). Amsterdam: Elsevier Science.

Renn, Ortwin, Dressel, Kerstin, Dreyer, Marion, Klinke, Andreas, Nishizawa, Mariko & Rohrmann, Bernd (2006/forthcoming). Managing systemic risks. Solutions for a changing world.

van Asselt, Marjolein B. A. (2000). Perspectives on uncertainty and risk. Dordrecht and Boston: Kluwer.

WBGU, German Advisory Council on Global Change (2000). World in transition. Strategies for managing global environmental risks. Annual Report 1998. Berlin: Springer.

Wiedemann, Peter M., Mertens, Johannes & Schütz, Holger (2000). Risikoabschätzung und Erarbeitung von Optionen für mögliche Vorsorgekonzepte für nichtionisierende Strahlung. Arbeiten zur Risiko-Kommunikation, Heft 81. Jülich: Forschungszentrum Jülich.

Andreas KLINKE is lecturer for risk management in the International Policy Institute at King's College London. KLINKE received his degree of doctor in political science at the Darmstadt University of Technology, Germany. He was director of the risk research team at the Center for Technology Assessment in Stuttgart (Germany). He was also researcher of the German Advisory Council on Global Change. KLINKE published on risk evaluation, risk management, international governance, and public deliberation.

Contact

Dr. Andreas Klinke

King's College London

International Policy Institute

Strand

London WC2R 2LS, UK

E-mail: andreas.klinke@kcl.ac.uk

Ortwin RENN is full professor for environmental and technology sociology at the University of Stuttgart, Germany. He is Chair of the Scientific Advisory Board of the Foundation "Precautionary Risk Management", member of the International Risk Governance Council in Geneva and several risk-related advisory boards. He was Chair of the German Federal Committee on the Harmonisation of Risk Standards (2001-2003). He has published widely on risk management and participative procedures. He has more than 25 years of intense experience with many innovative forms of stakeholder involvement and public participation on a multitude of issues.

Contact

Prof. Ortwin Renn

University of Stuttgart

Department of Sociology of Environment and Technology

Seidenstr. 36

70174 Stuttgart, Germany

E-mail: ortwin.renn@soz.uni-stuttgart.de

Klinke, Andreas & Renn, Ortwin (2006). Systemic Risks as Challenge for Policy Making in Risk Governance [27 paragraphs]. Forum Qualitative Sozialforschung / Forum: Qualitative Social Research, 7(1), Art. 33, http://nbn-resolving.de/urn:nbn:de:0114-fqs0601330.